A closer look at China-US Trade.... [or the shift of trade power from West to East...]

On the verge of their summit, Presidents Xi and Trump could not be in more different places. President Xi has become the champion of globalisation and a world order at which China is centre-stage. The National Congress of the Communist Party of China confirmed his leadership of the country for at least the next five years with no clear successor. By incorporating Xi’s philosophy to make China great into its constitution, the Party elevated Xi to the same status as Mao Tse-tung and Deng Xiaoping. China’s "One Belt One Road" policy, alongside its promotion of trade at the WTO means it is has become the focus, not just for trade between emerging economies in the Southern hemisphere, but also a pivot around which trade power is shifting from West to East.

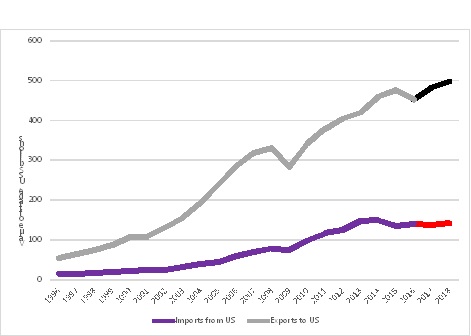

In contrast, Donald Trump travels to Asia on the tide of economic nationalism and isolationism. His anti-trade rhetoric is, at best, damaging many of the multi-lateral structures that have been central to the way in which globalisation, such as the North America Free Trade Area (NAFTA), the EU, and, most recently, the Trans-Pacific Partnership (TPP) and the Transatlantic Trade and Investment Partnership (TTIP). Trump’s discussion with Xi will focus on reducing, even eliminating, China’s trade surplus with the US (Figure 1). This trade surplus is nothing new, but has been widening since the mid 1990’s when China’s market first started to open up; Microsoft, for example, moved into the market around 1996. In 1996 China’s imports from the US were 27% of their exports to the US. This peaked at 35% in 2013, but the gap has been narrowing since and now stands at 31%.

Figure 1: The Value of Chinese Trade with the US ($US bn), 1996-2018 (2017 & 2018 forecast)

Source: Equant Analytics, 2017

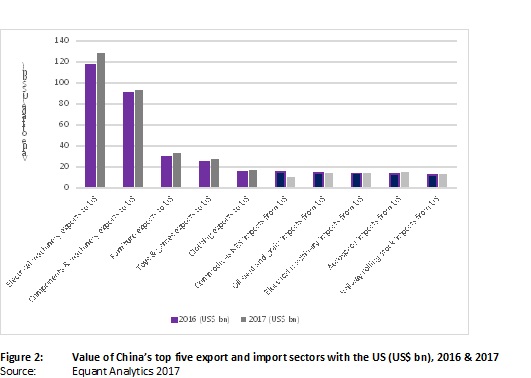

Indeed, it is possible to argue that Chinese exports to the US are a function of the globalisation of US electronics companies. Figure 2 shows the top five Chinese export sectors to the US in 2016 and projected for 2017. The first two - electrical machinery and equipment and components and machinery - include mobile phones, washing machines, semiconductors and computers. Clearly, they inherently contain intellectual property which is a key focus for the discussions between the two leaders. These sectors also dwarf trade between the two countries in other sectors which actually might reflect more closely a pattern of trade between an emerging economy and a developed one: furniture, toys and clothing. Top US exports to China include the catch-all “Commodities Not Elsewhere Specified” which proxies well for oil and arms trade, and aerospace. Most of the top export sectors from the US to China show slight declines between 2016 and 2017 except aerospace.

Figure 2: Value of China’s top five export and import sectors with the US (US$ bn), 2016 & 2017

Source: Equant Analytics 2017

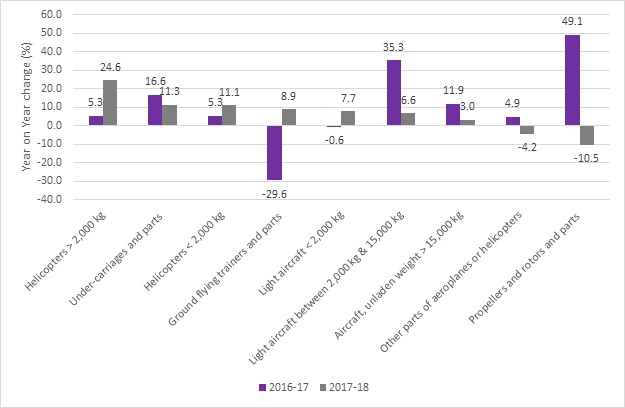

President Trump’s mantra since his election has been “America first” and most recently his actions in relation to Canada’s Bombardier were directly to support Boeing. In his discussions with President Xi, therefore, it is likely that aerospace could also be a key part of the trade negotiations (Figure 3). For example, exports of large aircraft were worth US$ 124 billion in 2016 and exports of large and smaller helicopters are projected to grow at 24.6% and 11.1% between 2017 and 2018.

Figure 3: Chinese imports of aircraft from the US, 2016-17 and 2017-18 compared (year on year change, %)

Source: Equant Analytics, 2017

In spite of all this, between China and the US it is clear who is in the weaker position. Perhaps because the US is realising that the period of globalisation up to around 2014 tilted trade, indeed economic power, towards emerging economies like South Korea and China, President Trump is now fighting a rear-guard action to maintain the central role in global trade that US companies have historically played. Using China’s trade in arms and ammunition as an example; China’s exports have grown at an annualised rate of 6% since 2009 while its imports have shrunk by 20% annually. Its imports are now just 2.5% of its exports in this sector. This tells its own story: while the US assumed it had global trade power leadership, it can no longer take this for granted. Globalisation and trade power is pivoting towards China.

CEO Dr. Rebecca Harding, Economist

and Liveryman

Women in FinTech Powerlist, 2017: http://womeninfintech.co.uk/wp-content/uploads/2017/11/wif_2017_powerlist.pdf

Email: rh@equant-analytics.com

Tel: +44-(0)7803-710711

Twitter: @RebeccaAHarding

Skype: rh.equantanalytics

“The Weaponization of Trade: the Great Unbalancing of Politics and Economics”

Rebecca Harding and Jack Harding.

October 25th 2017 * 170pp paperback *£9.99

ISBN 978-1-907994-72-2

ORDER HERE: http://londonpublishingpartnership.co.uk/weaponization-of-trade/