Positive Brexit....?

Brexit was unthinkable. And yet it has happened. In Theresa May’s words, “Brexit is Brexit” and the UK as a nation has to live with the consequences...

Much of the reason for the vote to leave was based on uncertainty: a palpable sense that, whatever the outcome, the UK was heading for a period of uncertainty. That uncertainty created real fear that jobs would be lost, houses lost, sovereignty lost and, most importantly of all, control over our own lives and destinies lost. The vote was a huge vote of no-confidence in the political and, let’s face it, economic establishment to come up with the right answers that resonate with real people. After all, we are experts, and what do we know about real people?

We know so little, in fact, that we now have to deliver an orderly exit from the European Union whether we want to or not. What format that takes and how long it takes is still unknown. We still don’t know when Article 50 will be triggered. It almost certainly won’t be this year and it could be as late as September next year if French and German elections are taken into account. Meanwhile, we are still members of the EU28 and have time to re-build our relationships with Europe and build the trust that we need to get through the negotiation process that will work for Europe as well as for us.

I would argue that it is incumbent on those who voted for Remain to take a positive and proactive approach to the Brexit process. Anyone who believes in the shared history and shared cultures that we have with Europe must now put their money where their mouth is and accept that they misjudged the mood of the British people and now need to be both conciliatory and diplomatic in finding a positive way through what is likely to be at best a tangle of economic uncertainty and market volatility and, at worst, a shock to the UK, the European and potentially the Global economies.

Perhaps the starting point is to acknowledge that the immediate aftermath of the vote has not been anywhere near as bad as everyone expected it to be. The Bank of England’s contingency plans kicked in immediately. While there were big losses, particularly to banks and property companies through the weeks after the vote, one month on, the FTSE 100 has reached new highs, the FTSE 250 has recovered, the banking sector has not seen a capital flight to match expectations, and the Bank’s Capital Buffers and liquidity measures acted as stabilisers anyway. The pound is 11% weaker, but this may have a positive impact on the UK’s beleaguered exporters, at least in the short term.

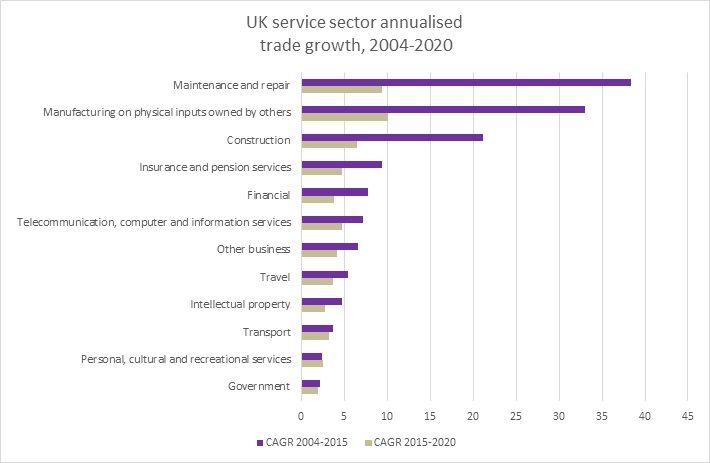

Our challenge is uncertainty, not Brexit in and for itself. For example, the UK trade picture looked less than rosy pre-Brexit (Figure 1). The chart shows a substantial drop in the growth of UK trade over the next five years compared to the past five years.

Figure 1: The outlook for UK trade 2015-2020 compared with trade growth 1996-2015

Source: Equant Analytics 2016

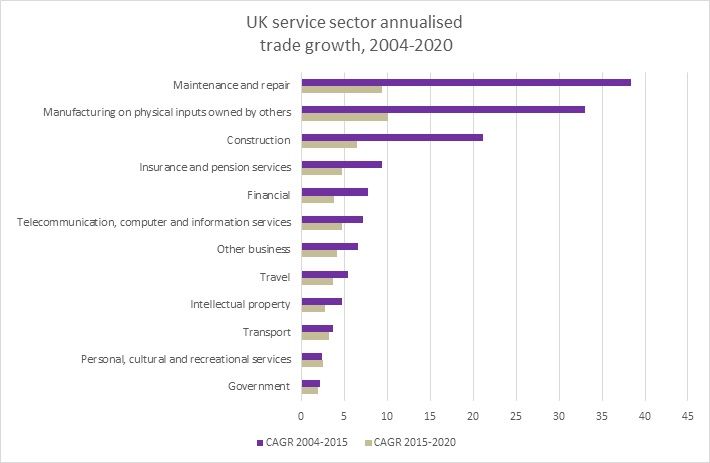

Indeed, the picture for services does not look substantially better and, as this is a key contributor to UK GDP, this is real cause for concern (Figure 2).

Figure 2: UK service sector growth, 2004-2015 and 2015-2020

Source: Equant Analytics 2016

This is a timely reminder of the pre-referendum vulnerability of the UK economy. We have forgotten that, irrespective of the result, trade has been slowing globally for the last five years, the economic slowdown in Asia has not fully worked through the economic system: even if it is currently out of the news, there are still major economic ripples working around the world. And Europe itself still has issues with liquidity and sovereign debt: Italian banks would not survive a financial crash and the sovereign debt issues of Greece are as important this year as they were last. The UK economy is global. Financial contagion spreads around the world, arguably through the trade system. Brexit may be the catalyst for accelerating some of the negative economic conditions elsewhere, but it will not be the only one.

What we don’t know is how the process will pan out, when it will happen or what the consequences will be. There are no precedents for “experts” to use. We are making it up as we go along. Every single economic forecast from every major forecasting organization has been revised down. But we don’t know whether this will happen because the trends on which the forecasting is based are pre-Brexit rather than post-Brexit. Any survey data published now is reactive, not substantive.

At the end of the day, we just don’t know. What we do know is that the global economy isn’t as strong as it should be. US GDP figures confirm that. We know that Article 50 will be invoked at some point in the next year and that when it is invoked, it will create some volatility in markets. We also know that, right now, nothing has changed. A constructive, “Business as Usual” approach is the only one to take as a result. 30 June, 2016

Dr Rebecca Harding, Liveryman

CEO, Equant Analytics,

Co-Founder and CEO

Tel: +44 (0)7803 710711

Email: rh@equant-analytics.com

Twitter: @RebeccaAHarding

Skype: rh.equantanalytics